OH MY GOD! You haven’t changed at all since I last saw you years ago! Still look so young and pretty!

, exclaimed the well-dressed Tai-Tai A as she gave Tai-Tai B a big hug over a table at Starbucks.

Don’t flatter me lah. *Hiaz* My two kids have been giving me sleepless nights all this while. In fact, I’ve just seen the school principal after one of them was allegedly involved in a big fight in some rugby game *smacks forehead*

How’s life for you?

, asked Tai-Tai B.

Same old routine everyday. Shopping, gym and spa in the day. Mahjong at night if I can gather the girlfriends. Plus the occasional weekend shopping trip to Japan and Korea. Life’s getting boring to be honest.

, replied Tai-Tai A, as she twiddled her exquisitely manicured fingernails.

Wow enjoying life huh? I still have to take care of my two kids, and face my two parents-in-law every day as they are living with us in our HDB flat!

, protested Tai-Tai B.

Gosh you are still living with his parents??? My husband and I moved into our spanking new condo the day we got married. Till now no parents, no kids – just a new convertible sports car we bought last year Haha.

Tai-Tai A‘s fingers moved slowly to caress the 1-carat diamond on her ring.

Ooh I’m so envious! And to make things worse, I have to handle everything by myself every time my husband gets called up for those stupid NS stints!

, complained Tai-Tai B.

The you should have married a PR like what I’ve done! No NS! Hee hee …

It’s now Tai-Tai A‘s LV bag’s turn to be fondled.

Eh tomorrow’s tax filing deadline. You filed your taxes already?

Yes I just helped my husband calculate his income last night.

Oh so how much did your husband earn last year?

Errr … can don’t say or not? Embarassing lah especially when compared to yours! Let’s just say that his total tax payable is 4% of his total annual income.

Oh I see. We did ours last night too and my husband’s total tax payable is 6% of his total annual income. Oh well … earn more pay more … what to do? *Sigh*

As Tai-Tai B‘s face began turning green with jealousy, unbeknown to them, a kaypoh maths tutor had been busily eavesdropping on their entire conversation from the next table. And being unable to tolerate Tai-Tai A‘s hao lian bitchy attitude, she began to stroke the keys on her calculator in an attempt to find out exactly how much their husbands were earning …

As stated, Tai-Tai A‘s husband’s total tax payable is 6% of his total annual income and Tai-Tai B‘s husband’s total tax payable is 4% of his total annual income.

Given that both Tai-Tais are not working (obviously, else they won’t be Tai-Tais), and that their husbands are entitled to the following reliefs, where applicable (Source: IRAS 2009):

- Personal: $1000

- Parent: $7000 per parent staying with them / $4500 per parent not staying with them

- Spouse: $2000

- Children: $4000 per child

- NSMan: $3000 where applicable

Using information from their conversation above and IRAS 2009 tax rates below, calculate the total annual income of each husband to find out whose husband earns more.

| Chargeable Income | Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 | 0 3.50 | 0 350 |

| First $30,000 Next $10,000 | – 5.50 | 350 550 |

| First $40,000 Next $40,000 | – 8.50 | 900 3400 |

| First $80,000 Next $80,000 | – 14 | 4300 11200 |

| First $160,000 Next $160,000 | – 17 | 15500 27200 |

| First $320,000 Next $320,000 | – 20 | 42700 |

While it’s highly unlikely that you’ll be asked to read through such a lengthy bitchy conversation in an actual exam question on the minor topic of taxation, there’ll still usually be a wee bit of reading comprehension involving the basics of calculating taxes i.e.

- All mortals are taxed on their

Chargeable Income = Total/Gross Annual Income − Reliefs - Find out which row in the given tax rates table the chargeable income falls into.

By the way, Tai-Tai A just asked again …

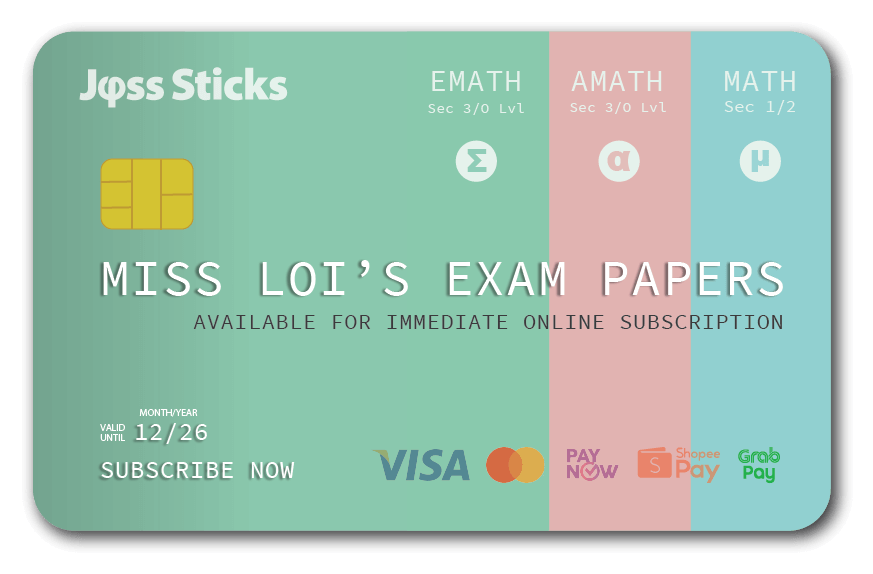

Miss Loi is a full-time private tutor in Singapore specializing in O-Level Maths tuition. Her life’s calling is to eradicate the terrifying LMBFH Syndrome off the face of this planet. For over years she has been a savior to countless students …

Miss Loi is a full-time private tutor in Singapore specializing in O-Level Maths tuition. Her life’s calling is to eradicate the terrifying LMBFH Syndrome off the face of this planet. For over years she has been a savior to countless students …

2 Comments

曜

日

Hey the condo is sparkling not spanking.

Are you sure you can do this question? think about 45min le(include referencing to Discovering Mathematics 4B) and i cant even know how to start!!! need to do this le:orz and burn more joss sticks(or rather learn this topic 1st)

曜

日

@qwerty1106: Ha! Just caught this comment ...

As mentioned, this question is a little atypical so you won't discover any clues in Discovering Mathematics (pun not intended).

Though the process of obtaining the in this case is admittedly a wee bit involved, the essence of solving this type of local taxation problem (where we're shown our mighty IRAS tax table) is basically the same i.e. find which row does the chargeable income falls into.

As chargeable income = total income − reliefs, we first calculate the reliefs of each Tai Tai's husband

Tai Tai A's husband's total reliefs (read through the paras in red)

= $1000 (personal) + $2000 (Spouse) + 2 × $4500 (Parents not staying - ok let's assume her husband is a filial only child with both parents still alive)

= $12000

Tai Tai B's husband's total reliefs (read through the paras in green)

= $1000 (personal) + $2000 (Spouse) + 2 × $7000 (Both parents staying with them) + 2 × $4000 (two kids) + $3000 (NSMan)

= $28000

Now we don't know how much they earn, but we're given their tax payable as a % of their total income. To find out which row of the table they belong to, we can deduce from the table the maximum % of total income they are taxable at each row:

=max tax payable/(max chargeable income+ relief ($12000))

=max tax payable/(max chargeable income+relief ($28000))

So from their given percentages of 6% and 4% we can see from the table above that their total chargeable income is somewhere between $80000 and $160000.

⇒ Tax that each of them have to pay (t)

= $4300 (for the first $80000) + 14% of the part of the next $80000 (= total chargeable income (i) − $80000)

And since we know that

and

and

Can you solve for the unknowns and see whose husband actually has a higher total income? 😉